Access a network of clean energy developers and source the right tax credits for your company

Streamlined tax credit transfers

- Source Opportunities Fit for your Company

- Mitigate Transaction Overhead with Our Software and Diligence Collection Services

- Contract for the Projects, Insurance, and Indemnities that Work for your Company

- Align Tax Credits with Estimated Tax Payments

- Reduce your Corporate Income Tax Burden

-

Onboarding

- Go over your tax team’s transfer parameters

- Build your ecosystem of counsel, underwriters, and consultants

-

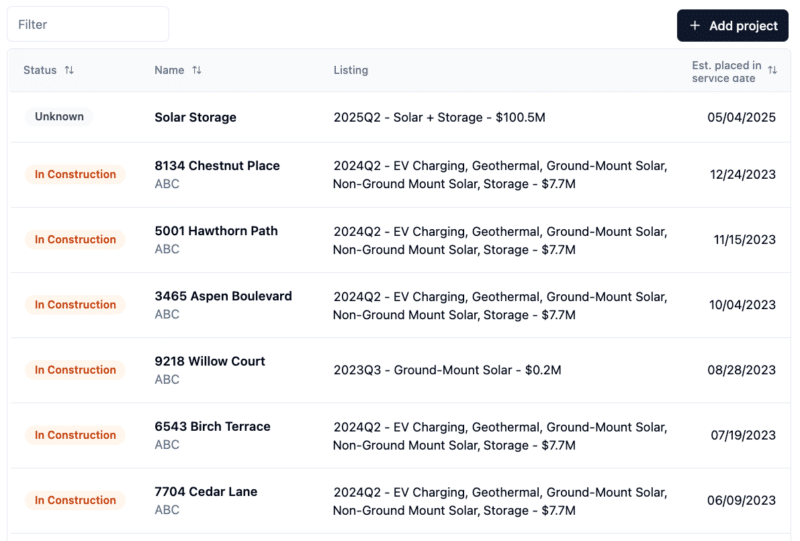

Supply Aggregation

- Acquire insured tax credits or leverage seller balance sheets for indemnities

- Our pool of sellers covers the range of clean energy technologies and deal sizes

-

Structuring and Savings

- Overhead Minimization: Single transactions to cover an entire year’s tax bill

- Spot Purchases: Quarterly purchases to match estimated tax payments

-

Anonymity and Optionality

- Protect your company’s identity as your team works through bids to lock a transaction

- Transactions are blind and non-binding until your organization is ready to engage

-

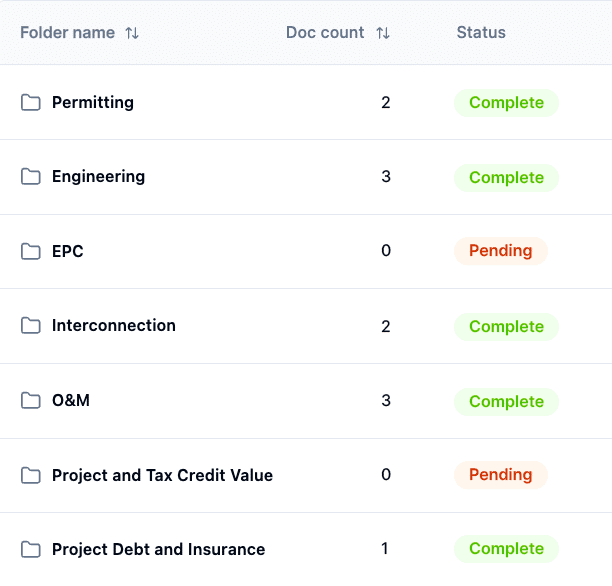

Transaction Management

- Common Forge’s technology platform simplifies document collection and diligence management

- Utilize our collaboration features to keep your transaction marching along for a timely close

Get Started

Connect with us to get started on the tax credit transfer transaction that’s right for your company