Quarterly tax credit monetization and management allows for more efficient monetization of tax credits.

As a starting point, Treasury’s proposed guidance clarifies that tax credits purchased or expected to be purchased can be applied to the transferee’s tax bill.

This does not necessarily mean that the taxpayer can apply a tax credit they haven’t paid for to their tax returns, however, and there are some widely followed industry norms to consider before diving into economics.

Disclaimer: Common Forge does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

First Question: Can a tax credit be applied to quarterly returns?

- Answer: As per the proposed guidelines, yes.

Second Question: Should the credit be paid for before it is applied to a tax return?

- Answer: In general, yes. A convention that the renewables industry has followed is in US Code 6655-2 – Annualized income installment method.

Third Question: Can tax credits purchased in one quarter that go online in that quarter be applied to a subsequent quarter?

- Answer: Following the from the above US Code example, yes. In the example, a R&D tax credit overage in one quarter is applied to a subsequent quarter.

In general, tax credit buyers only pay for tax credits at the time of the execution of a transfer agreement, and the norm today is largely that transfer buyers pay at or after the Placed-in-Service date of a project.

Result

Following from the above, we have the following assumptions:

- Tax credits can straightforwardly be applied to an estimated quarterly payment if the tax credit buyer has paid for the tax credit in that quarter and the facility has been placed in service

Examples

Now that we understand how tax credits can be applied quarterly and annually, we go through two examples of a corporate purchaser applying the credits to their quarterly or annual returns.

Key Assumptions

- Tax Credit Price: $0.90 / $1.00 of Tax Credit

- Interest Rate: 7%

- Tax Liability Applicable to Tax Credits: $100M, incurred in proportion to the days in tax quarter.

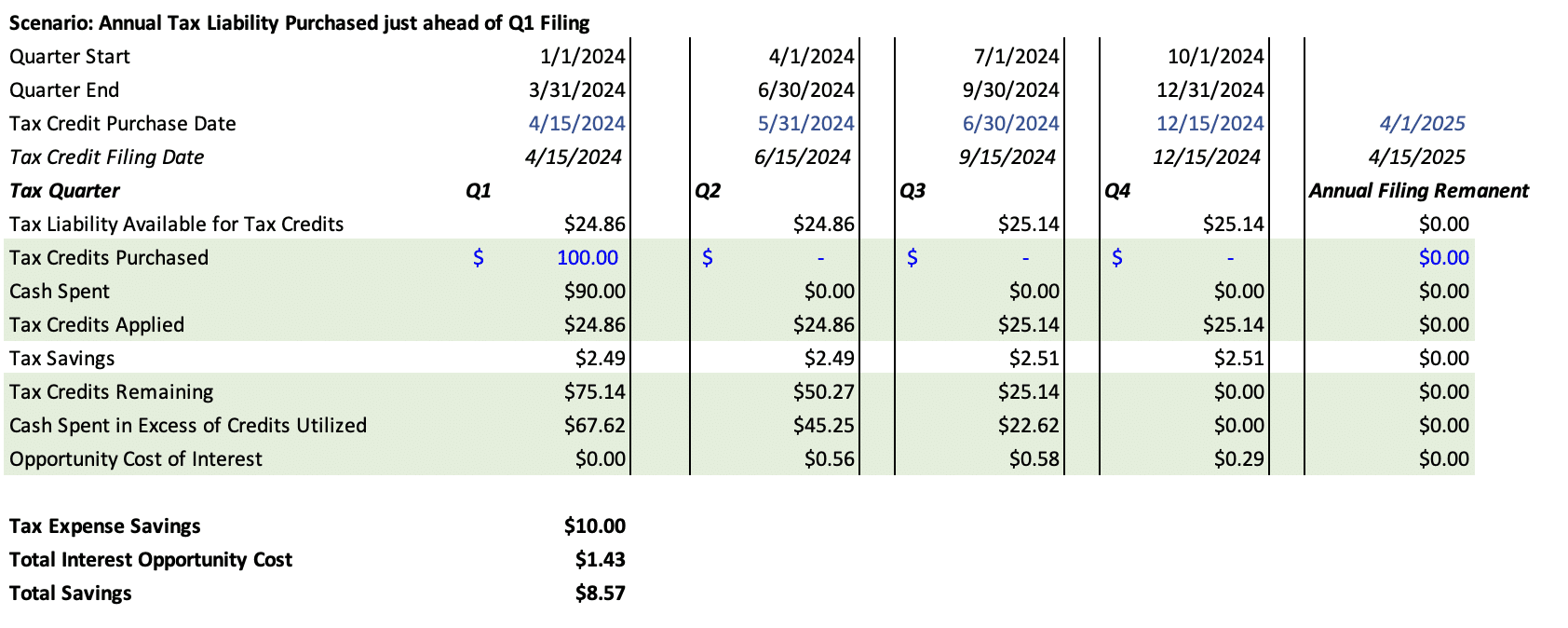

Annual

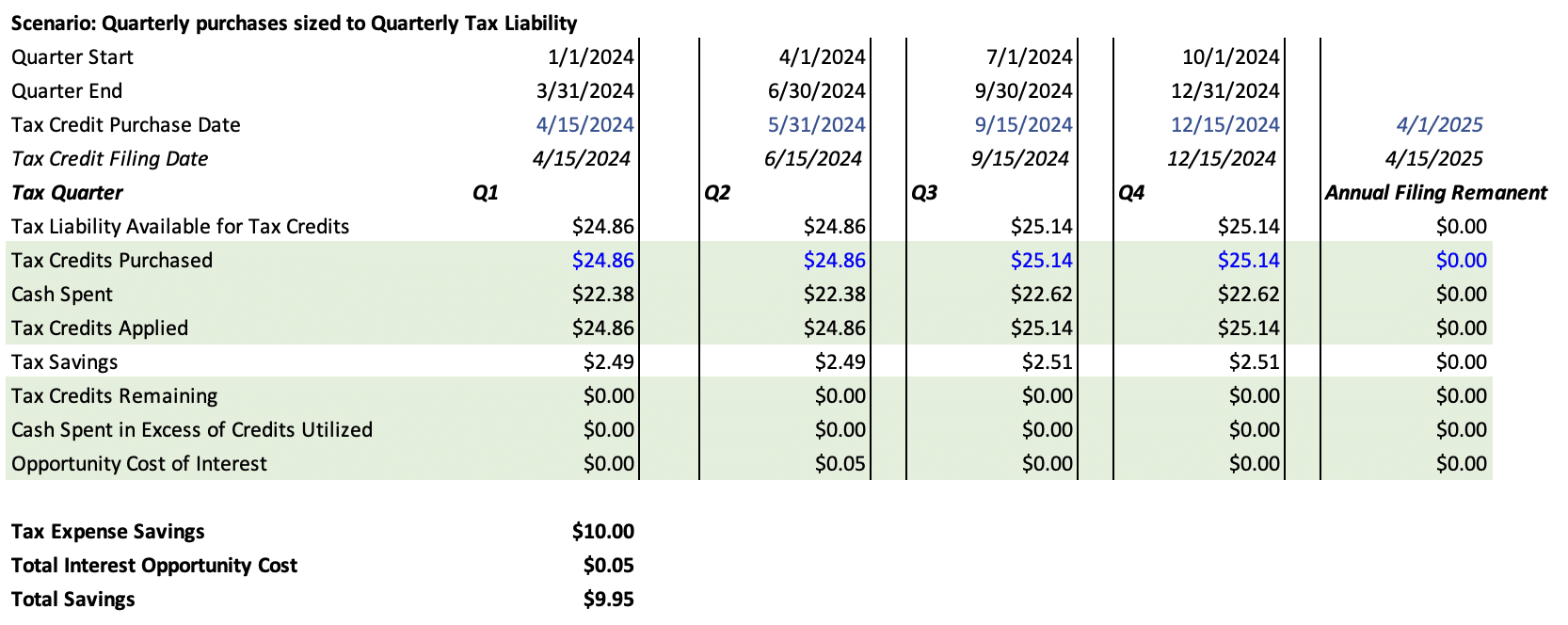

Quarterly Purchases

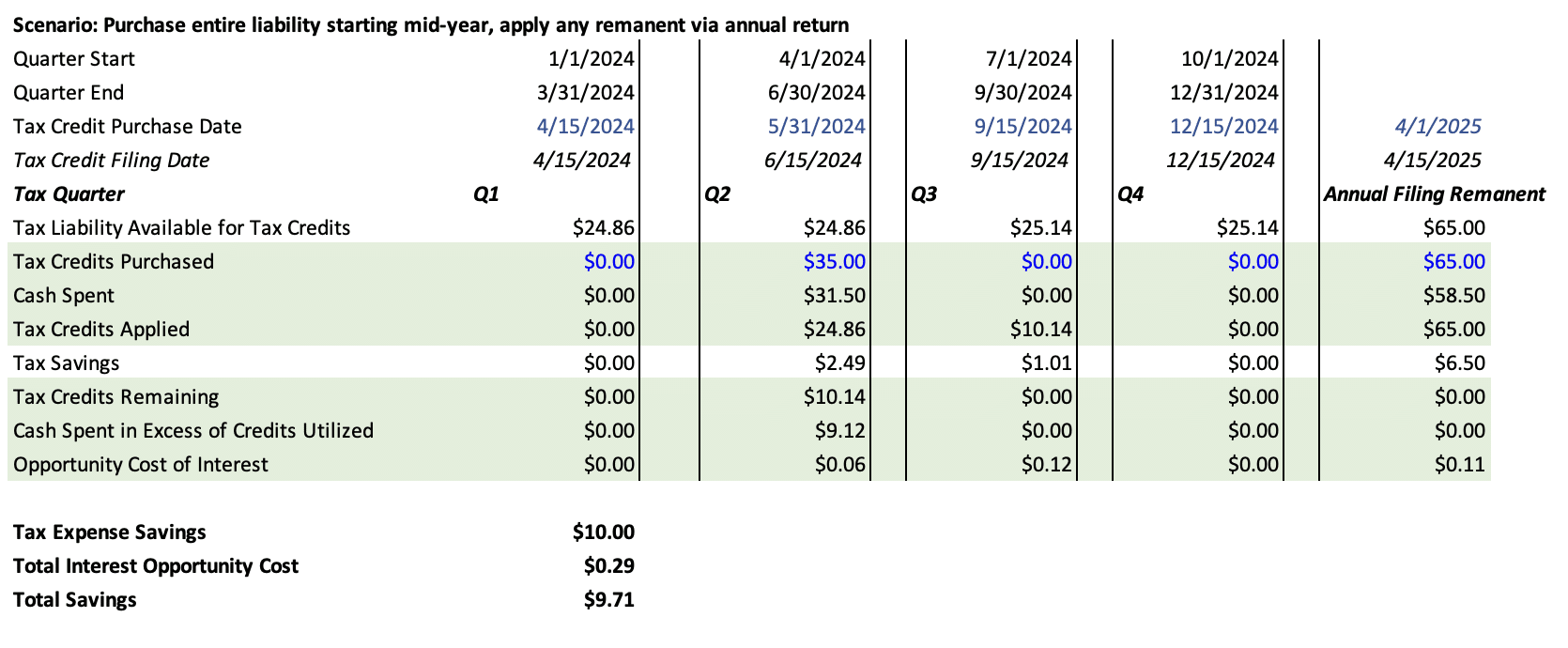

Purchases Starting Mid Year